Blue Ocean Strategy: Who It Helps (and Who It Mostly Won’t)

Who can actually make competition irrelevant—and who’s kidding themselves.

Introduction

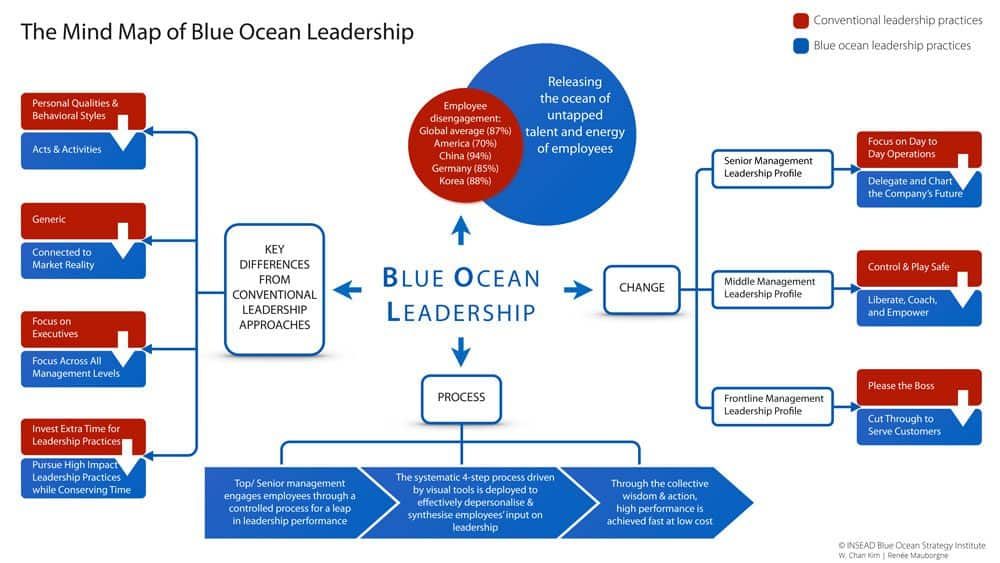

Blue Ocean Strategy (BOS) is simple in concept: stop trying to “win” by out-muscling rivals in a crowded market, and instead redesign the value proposition so you create new demand and make the old comparisons less relevant.

Kim and Mauborgne describe it as the simultaneous pursuit of differentiation and low cost (“value innovation”), supported by tools like the Strategy Canvas and the Eliminate–Reduce–Raise–Create (ERRC) grid.

That all sounds great—until people try to apply it everywhere. So here’s a practical split: where BOS tends to work, and where it tends to disappoint.

Where Blue Ocean Strategy tends to work (high payoff environments)

Businesses selling into “nonconsumption”

If a big chunk of the population isn’t buying at all—because it’s too expensive, too complex, too intimidating, or too inconvenient—BOS can unlock growth by making the category easier to adopt.

Good fits:

- Fitness, wellness, personal finance, education, DIY services

- B2B software/tools that remove “setup pain” and training friction

- Why it works: you’re not “stealing share,” you’re converting nonbuyers into buyers—exactly the BOS playbook.

- Markets bloated with features customers don’t actually value

- Some industries slowly become a junk drawer: more features, more options, more “premium,” more confusion. BOS thrives when you can cut the dead weight and repackage value around what people truly care about (often simplicity, speed, predictability, and a clean experience).

Good fits:

- Consumer tech accessories, subscription services, home services, specialty retail

- Professional services with messy scope, unclear deliverables, and weak customer experience

- Fragmented industries with weak differentiation

- If the industry is a sea of “me-too” providers and customers compare mostly on price and availability, BOS can work

by changing the basis of competition (offer structure, guarantees, packaging, transparency, speed, service design).

Good fits:

- Local services (home improvement, maintenance, cleaning, landscaping, moving)

- Many B2B agencies (marketing, bookkeeping, managed IT)

- Businesses that can reshape the buyer experience (not just the product)

- BOS isn’t only “invent a new product.” Often it’s changing the end-to-end experience: how people discover, buy, onboard, use, and get support.

Good fits:

- Businesses with high customer anxiety or complexity at purchase

- Businesses where trust and clarity matter as much as the deliverable

- Organizations with operational leverage

- BOS looks like magic when you can remove costly complexity and simultaneously create a better experience. That

requires real operational discipline—process, supply chain, delivery systems, training.

Good fits:

- Companies that can standardize, template, modularize, automate

- Companies with scale or repeatable delivery models

- Where Blue Ocean Strategy usually does NOT work (or works poorly)

- Pure commodities with transparent pricing

- If buyers see the product as interchangeable and price is publicly comparable, BOS is hard. Not impossible—but

you typically have to move “around” the commodity (service layers, logistics, bundling, risk reduction) rather than

pretending the commodity itself becomes special.

Examples:

- Basic raw materials, undifferentiated resale goods, fuel as a product

- Reality check: the value-cost tradeoff is brutal here. BOS may help with packaging and distribution, but not the core

commodity.

- Heavily regulated pricing and constrained business models

- When pricing, reimbursement, product design, or routes-to-market are tightly controlled, BOS has less room to

maneuver. You can innovate, but your “blue ocean” is often limited to process innovation, service experience, or

adjacent offerings.

Examples:

- Certain healthcare reimbursement models, utilities, tightly controlled financial products

- Macro constraints matter—BOS tools don’t automatically account for them.

- Winner-take-all markets dominated by network effects

- If the category is controlled by a platform where value rises with user count (and switching costs are high), you

don’t “make competition irrelevant” by drawing a prettier strategy canvas. You either: piggyback on the dominant

network, carve out a narrow niche, or bring a step-change technology/distribution advantage.

Examples:

- Social networks, major marketplace platforms, certain messaging ecosystems

- BOS can still inspire positioning, but the economics are not friendly.

- Markets where the buyer only rewards credentials, compliance, and risk controls

In some spaces, the buyer does not want novelty. They want predictability, compliance, and “don’t get me fired.”

Examples:

- Defense procurement, mission-critical infrastructure, regulated enterprise procurement

- BOS can help at the margin (faster compliance, clearer delivery, lower risk), but radical “new market space” is rare.

- Capacity-constrained businesses that can’t scale deliver

If your business cannot deliver more volume without quality collapsing (or without major hiring/training bottlenecks), - BOS can create demand you can’t fulfill. That turns “blue ocean” into “reputation damage.”

Examples:

- Specialist trades, boutique professional services, high-touch consultancies

If you can’t scale, your strategy must emphasize selectivity and pricing—not mass demand creation.

- Businesses BOS helps most often (quick cheat list)

Strong candidates:

- Consumer services with friction (health, fitness, education, home services)

- Subscription businesses (where simplification + clear outcomes win)

- Retail categories crowded with gimmicks (where clarity wins)

- B2B tools/services replacing complexity with a clean system

- Any business able to reduce cost by eliminating complexity while improving the experience

Weak candidates:

- Commodities with transparent price competition

- Highly regulated pricing environments

- Network-effect platform wars

- Markets where novelty is punished and compliance is the product

- Businesses that cannot scale delivery capacity without breaking quality

The “Blue Ocean” self-test (use this before you fall in love with the idea)

If you answer “yes” to most of these, BOS is worth real effort:

- Are there large groups of nonbuyers (or “reluctant buyers”) you can convert?

- Can you eliminate or reduce costly features customers don’t value (ERRC)?

- Can you change what customers compare (speed, certainty, simplicity, transparency, guarantees)?

- Can you deliver the new value curve operationally (without chaos)?

- Can you protect the move long enough to profit before imitators arrive?

- Is regulation/platform dominance NOT the main limiter?

- Can you scale without quality collapse?

If the honest answers are mostly “no,” BOS may still offer insights—but it won’t be your main growth engine.

The part most people ignore: Blue oceans don’t stay blue

Even the original BOS framing makes clear that competition catches up.

The real question isn’t “Can we escape competition forever?”

It’s “Can we create a meaningful leap in value, align cost and delivery, and monetize the lead time before the ocean turns red again?”

This is also where critics have a point: the idea is powerful, but implementation is the hard part—and evidence can lean heavily on case studies rather than universal rules.

Why This Matters

Blue Ocean Strategy is not a magic wand. It’s a lens—and it’s most useful when it forces you to stop copying your competitors and start asking a sharper question: “What would we cut, simplify, or redesign so customers who currently avoid this category would finally buy—and be happy they did?”

When you use BOS in the right environment, it can be a growth weapon. When you use it in the wrong one, it becomes an expensive brainstorming exercise.

References

Burke, A. E. (2009). Blue ocean versus competitive strategy: Theory and evidence. SSRN.

Kim, W. C., & Mauborgne, R. (2004). Blue ocean strategy. Harvard Business Review.

Kim, W. C., & Mauborgne, R. (2005). Blue ocean strategy: How to create uncontested market space and make the competition irrelevant. Harvard Business School Press.

Kim, W. C., & Mauborgne, R. (2005/2006). Blue ocean strategy: From theory to practice. California Management Review.

Kim, W. C., & Mauborgne, R. (n.d.). Value innovation (tool overview). BlueOceanStrategy.com.

Mutua, J. (2025). A critique of blue ocean strategies: Exploring the limits of creating uncontested markets (PDF).

Disclaimer:

The views expressed in this post are opinions of the author for educational and commentary purposes only. They are not statements of fact about any individual or organization, and should not be construed as legal, medical, or financial advice. References to public figures and institutions are based on publicly available sources cited in the article. Any resemblance beyond these references is coincidental.