The NFL Has Become Boring — Because Parity Works a Little Too Well

When every team is “alive,” nothing feels epic.

Remember when the NFL had true villains and mythic dynasties? You didn’t need a hype video to care about 49ers–Cowboys, Steelers–Ravens, or Peyton–Brady. You tuned in because greatness was on the other sideline and your team had a shot at slaying a giant—or getting trucked by one. Today’s league sells “any given Sunday” so hard that most Sundays blur together. The product isn’t bad; it’s bloodlessly efficient. The better word is boring.

Here’s the working theory: structural parity, born from the cap/free-agency era, has done its job so well that it scrubbed away the extremes—dominant peaks and catastrophic valleys—that make sports unforgettable. Add in an ocean of guaranteed national revenue flowing to owners no matter the standings, and you get a league optimized for stability over story. Fans get drama-by-algorithm. Owners get checks. And the season feels like a long conveyor belt of 23–20 games you’ll forget by Tuesday.

Let’s unpack why.

Parity’s Promise—and Its Quiet Cost

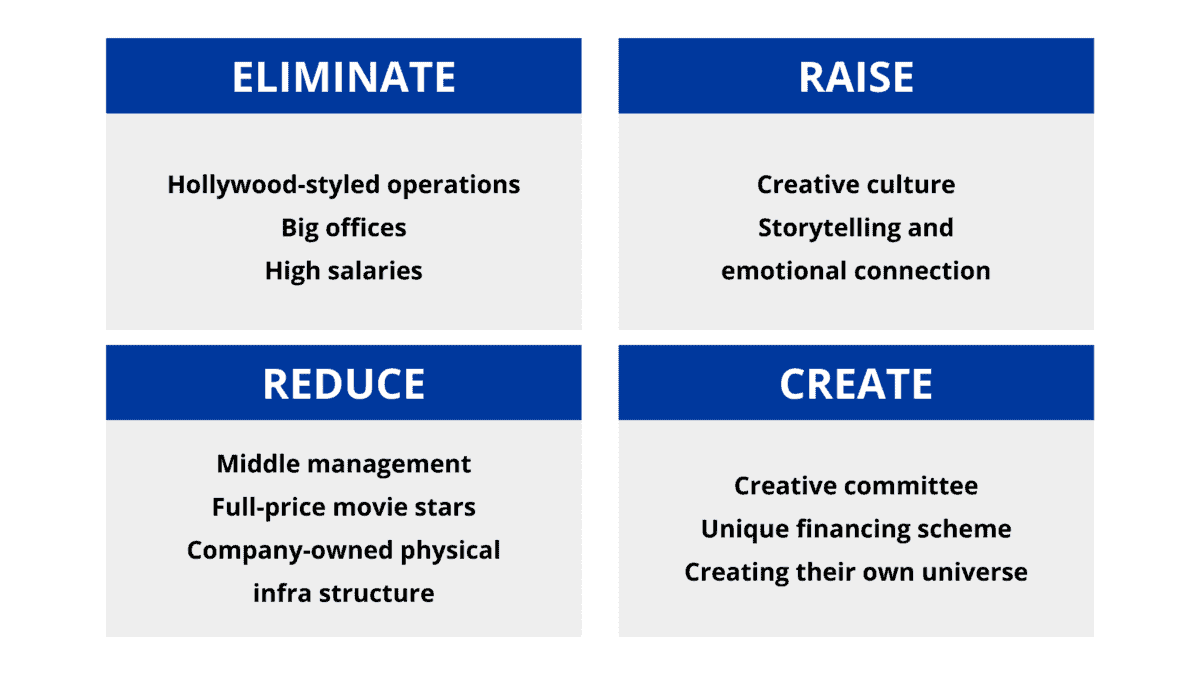

The NFL’s modern architecture—hard salary cap, universal national media money, reverse-order draft, comp picks, franchise tags—was designed to compress the gap between best and worst. Mission accomplished. Since the cap and true free agency arrived in 1994, the league’s middle class has ballooned. Cap growth has been massive the past two seasons (2024 to 2025 alone jumped from roughly $255.4M to $279.2M per team), and the mechanisms that once rewarded continuity now punish it. Win big? Your stars get expensive, your coordinators get poached, your draft slot tanks, and the compensatory formula nicks your flexibility.

Fans feel it as churn. Continuity—the emotional glue of fandom—gets traded for “optionality.” Rosters flip yearly as cap managers arbitrage veteran guarantees versus rookie deals. Your favorite linebacker? One-year rental. That nasty interior OL pairing? Split for a 4th-rounder and cap relief. Parity creates a league full of 8–9 to 10–7 teams that look interchangeable on RedZone. The edges—the 14–2 juggernauts and 2–14 train wrecks—exist less often and for shorter windows. Great for competitive balance metrics; rough for memory.

Sports are about narrative gravity. When the system keeps yanking teams back toward .500, gravity weakens.

Free Agency: Good for Players, Bad for Folk Heroes

Let’s be clear: player movement freedom is a net moral good. Guys should get paid. But there’s a product cost. The league used to mint folk heroes who belonged to cities—guys who embodied a region’s identity for a decade. Now, even franchise faces bounce (or threaten to) when the guaranteed-money window opens. You get a lot of “three-year cultures” that evaporate with one coordinator hire or one extension that ages poorly.

Free agency also incentivizes mercenary roster builds: assemble a cap-efficient patchwork that can win 9–10 games and hope the bracket breaks right. That strategy is rational; owners aren’t paying for bronze busts, they’re paying for playoff gates and risk management. But rational isn’t romantic. Rational is beige.

Analytics, Fourth Downs, and the Sterile Middle

I like math. You probably like winning. But fourth-down charts and two-point trees have pulled coaches toward a common decision surface. The mistakes that once made legends (or villains) are rarer; the wild outlier calls become social-media chum, not repeated identity. When everyone carries the same binder, you get stylistic sameness. There are exceptions—one team leans power gap, another lives in condensed sets—but homogenization is the undefeated champion of modern pro sports. It’s efficient. It’s also… samey.

The Owners’ Billion-Dollar Airbag

Here’s the part that flattens urgency: owners get rich no matter what. National media/sponsorship revenue—shared equally—has exploded. In the 2024 fiscal year, each club reportedly received about $432.6 million in national revenue distribution alone, a record reflecting roughly $13.8 billion at the league level. That’s before local gate, suites, concessions, parking, and in-market media. The broader business is surging toward (and in some analyses clearing) the mid-$20-billion annual range for total league revenue.

Television and streaming deals lock it in: an 11-year media-rights framework valued around $110 billion across partners (CBS, Fox, NBC, ESPN/ABC, Amazon, plus Sunday Ticket with YouTube) provides the world’s fattest content annuity. On a per-team basis, that’s a firehose sufficient to float even the sleepiest front office. The phrase “win, lose, or draw” isn’t just a cliché; it’s a business model. No relegation. No existential threat. New stadium? Often public money sweetens the pot. If the product is flat for a few years, national checks still clear on time.

What does that do to the on-field urgency? At the margin, it pushes decision-makers to safeguard the floor, not chase the ceiling. Why reach for dynasty-level risk when a consistent 9–10-win baseline plus one January bounce produces the same banners (division title, maybe a conference game) with less cap pain?

Manufactured Drama vs. Real Stakes

The league isn’t stupid; it knows to package tension. That’s why the playoff field keeps expanding, Week 18 features synchronized kickoffs, and graphics scream “IN THE HUNT” for teams that haven’t beaten a winning opponent. It feels like a prestige drama that doesn’t want to kill off any main characters.

There’s a difference between uncertainty and significance. Uncertainty says, “Anything could happen.” Significance says, “What happens will be remembered.” Parity overload gives us uncertainty on tap and significance in sips. Wild Card Weekend has become a gluttonous sprawl of almost-good teams. The more you invite to the party, the less special the invitation feels.

Fantasy, RedZone, and the Atomized Fan

This part’s on us. Fantasy and RedZone trained a generation to root for dopamine spikes, not arcs. The league happily feeds that habit: staggered kickoffs, island games every night, and scrolling lower-thirds reminding you of Player X’s PPR explosion. You can love that buffet and still admit it dilutes your bond to a team’s identity. If your emotional center of gravity shifts from “we won” to “my lineup ate,” you’re less angry when the local GM punts on continuity for cap efficiency. You’ll just draft a different WR3.

Identity Used to Be a Weapon

Dynasties were more than win totals; they were styles. Walsh’s precision West Coast. Parcells’ grimy bully ball. The Steel Curtain’s black-and-blue physics. Early Belichick’s shape-shifting, opponent-specific game plans. Today’s schematic diversity exists—football remains wildly complex—but its edges are smoothed by the cap, college pipelines, and copycat speed. Everyone lives in the same family of solutions: some flavor of quarters, simulated pressures, condensed sets, motion at the snap, play-action from under center, a dash of QB run. It’s all good ball. And somehow it all blends.

The Salary Cap’s Hidden Incentives

Caps don’t just level spending; they discipline ambition. If you “win” free agency with big guarantees, you usually “lose” two years later when restructures and void years hit. If you draft brilliantly for a two-year stretch and go all-in around a cheap QB, your reward is a cap cliff the minute you extend him. The cap is rising briskly—north of $279 million this year after a double-digit jump —but the leap helps everyone, preserving the middle more than empowering the bold.

This is why so many front offices converge on the same roster recipe: accumulate day-two draft darts, hit 55–60% of them, churn veteran role players on one-year deals, and pray your quarterback is either special or cheap. If he’s both, you’re a contender. If he’s neither, you’re a content provider.

“Any Given Sunday” Became “Every Given Sunday”

The NFL’s slogan used to promise chaos on the margins—upsets that kept favorites honest. Now it feels like the whole league lives inside that probability bubble. The cumulative effect is monotony: lots of one-score games, lots of field goals from the logo, lots of postgame pressers where coaches praise “complementary football” and fans stare at the standings wondering what, exactly, they just watched.

You know what breaks monotony? Stakes. Stakes need inequality—the risk that your team is outclassed or, better, that your team is the class. Parity strangles both possibilities. You can survive all season without ever discovering who you are because staying vaguely good is good enough.

The Business Is Thriving—That’s the Point

If you’re the league, this is chef’s-kiss perfect. Fans across 32 markets feel alive into December. National partners get a ratings monster that never sleeps. International inventory (Germany, U.K., soon more) opens new time windows and sponsorship categories. The average franchise valuation is now north of $7 billion per Forbes, up triple digits since 2021, as media money compounds and scarcity (only 32 teams) keeps the auction feverish.

From Park Avenue’s vantage point, boredom is a Twitter problem, not a P&L problem. But if you care about the sport as a cultural object—not just a content stream—you can feel what’s missing: the grandeur that comes when greatness is allowed to tower and failure is allowed to crater.

“But Dynasties Still Happen!”

They do, occasionally, because quarterback excellence bends gravity. The salary cap controls aggregate spending; it can’t manufacture truly elite QB play. When one surfaces, he becomes the cheat code that survives parity’s squeeze. But even the current “dynasties” feel administratively managed—carefully staggered guarantees, constant veteran trimming, coordinators churned through for comp picks—rather than organically mythic. Perfection can’t breathe when every January is a Land of 10,000 Wild Cards.

What Would Make It Less Boring?

You don’t need to blow up the cap or torch player freedom to put teeth back in the product. A few ideas:

- Compress the Playoffs. Roll back expansion. Fewer invitations raise the cost of a sleepy September and reward truly great regular-season teams with more than a bye and an injury risk.

- Reward Continuity. Create targeted cap exceptions for homegrown veterans so teams aren’t punished for keeping their own cores together. You’d keep local folk heroes without “buying” superteams on the open market.

- Dial Back International Novelties. They’re good business, but 6 a.m. kickoffs and neutral-site atmospheres flatten rivalry juice. Keep the schedule American-centric. Make the environments hostile again.

- Loosen the Algorithm. The league can’t ban math, but it can incentivize risk—tweaks to clock rules, kickoff returns, and defensive contact that produce more stylistic divergence. If every team solves for the same constraints, they’ll look the same.

- Re-center Local Broadcast Identity. National packages print money (and should), but carving out more local storytelling inventory—postgame shows with teeth, in-market docuseries—could re-bond fans to the team’s arc instead of the league’s churn.

None of that dent the owners’ annuity. It would, however, restore some asymmetry—the oxygen that makes a season feel like a saga.

The Counterargument (and Why It Doesn’t Move Me)

The parity evangelist will say: ratings are stellar; more fan bases are engaged longer; one-score games are exciting. True, true, and true. The NFL is the most successful entertainment product on Earth because it maximizes the middle. But as a sport, the middle is where memory goes to die. We remember the teams that sculpted identity across years and dared to be hated. Parity makes hate difficult. You can’t hate rotating cast members.

Owners Don’t Need to Chase Glory

The business reality is simple: national money dominates the revenue mix, and it’s split equally. A club can be run “fine” forever and still out-earn the GDP of a small nation. The current U.S. media rights framework spreads billions across ESPN/ABC, Fox, CBS, NBC, Amazon, and Sunday Ticket on YouTube for the better part of a decade. In 2024’s fiscal distribution, teams effectively started the year with ~$432.6M each wired in before selling a seat or a beer. That’s bigger than the entire salary cap by a mile. The “floor” is a penthouse.

When survival is guaranteed and profit is guaranteed, a rational owner optimizes for predictability. Fans hope for obsession. Owners model variance. Those are different religions.

What We Lost (and How to Get Some Back)

We lost the wild pride of saying my team does X and yours can’t stop it—and knowing that the same 22 dudes would try again next year. We lost the weekly anxiety of measuring up to a towering dynasty or the catharsis of finally cracking one. We lost the kind of hated rivals you can recognize by silhouette.

You don’t fix that by canceling free agency or nuking the cap. You fix it at the edges: fewer playoff slots, more continuity credit, less neutral-site content, and rules that let distinct philosophical bets flourish. Give us more identity and more consequence. The money will still gush. The memories will return.

Why This Matters

A league built to guarantee “everybody’s alive” ends up making nobody unforgettable. Parity has professionalized the sport into a smooth corporate product that never truly fails—and therefore rarely soars. Owners will keep cashing record media checks whether their club wins four games or fourteen; in 2024 fiscal distributions alone, national revenue per team eclipsed the entire salary cap by over 50%. Stability is wonderful for balance sheets. It’s terrible for myth-making.

If you feel less connected, it isn’t nostalgia talking. It’s structure. The NFL optimized itself into sameness. Bring back sharper edges—real stakes, stronger local identities, continuity that fans can grow old with—and the league will feel big again, not just big business.

References

- CBS Sports. “Here’s how much each NFL team made in national revenue in 2024, as revealed by Packers’ financial report.” (July 24, 2025). CBS Sports

- Yahoo Sports (via ESPN reporting). “NFL teams reportedly received a record $432.6 million in league revenue sharing.” (July 23, 2025). Yahoo Sports

- NFL Football Operations. “NFL Salary Cap.” (2025 figure and history). NFL Football Operations

- Spotrac. “NFL CBA & Salary Cap History.” (historical cap data). Spotrac

- Harvard Business School Case Library. “The NFL’s $110-Billion Media Rights Deals.” (overview of the 11-year framework). Harvard Business School

- Wikipedia (compilation with primary references to CNBC/Washington Post/NFL.com): “NFL on American television” (current partners and annual values; opt-out notes). Wikipedia

- Forbes. “The NFL’s Most Valuable Teams 2025.” (average valuations and revenue context). Forbes

- SportsPro Media. “NFL revenue ‘cleared US$23bn’ for 2024 financial year.” (April 11, 2025). SportsPro

- SportsPro Media. “Breaking down the business of the NFL in 2025.” (Sept. 1, 2025). SportsPro

Disclaimer:

The views expressed in this post are opinions of the author for educational and commentary purposes only. They are not statements of fact about any individual or organization, and should not be construed as legal, medical, or financial advice. References to public figures and institutions are based on publicly available sources cited in the article. Any resemblance beyond these references is coincidental.