Jimmy Kimmel: Mediocrity, Ideology, and the Falling Fortunes of Late Night

How Disney’s Loyalty to a Fading Late-Night Host Shows the Cost of Choosing Ideology Over Audiences

Introduction

There’s a reason America is tuning out of late-night TV: the joke stopped being funny a long time ago. Once the domain of irreverent wit, clever satire, and sharp commentary, late-night television has largely become ideological soap boxing—and no one embodies that shift more than Jimmy Kimmel. What once might have been background noise is now a signal flare for what happens when networks refuse to adapt, when content is out of touch, and when ideology trumps business.

This post breaks down why Kimmel is no longer merely irrelevant; how his decline is measurable; how Disney (via ABC) is complicit in propping up a failing format; and why the cost—cultural, financial, and reputational—is mounting.

Part I – The Decline in Ratings: Data Doesn’t Lie

To argue that Jimmy Kimmel’s appeal is waning isn’t just opinion—it’s backed up by year-over-year drops in viewership, especially in the key demographic, and major losses in audience share.

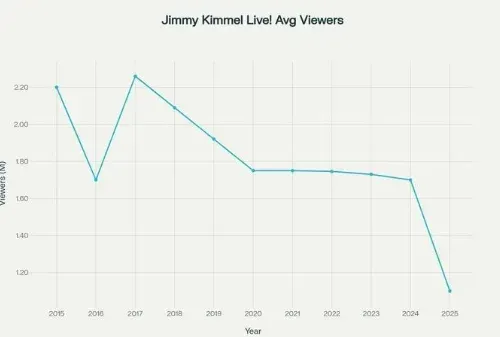

Ratings Drop Over Time

- Key demographic erosion: Viewership among adults aged 18–49 has plunged, reportedly down as much as 80% over the past ten years for late-night shows including Jimmy Kimmel, Stephen Colbert, and Jimmy Fallon.

- Kimmel’s recent numbers: In August 2025, Jimmy Kimmel Live! averaged about 1.1 million viewers, which is roughly a 43% drop from January 2025, when it had about 1.95 million.

- Demo collapse: For the same period, viewers in the 18-49 demo for Kimmel dropped to just 129,000 in August—down from around 284,000 in a previous period.

- Overall erosion: Reports show that among critical younger demographics (18-49), Kimmel has lost around 72% of his viewership over the last decade.

Competitive Comparison

- While all late-night hosts have seen declines, Kimmel is lagging behind in maintaining relevance and audience. Shows like Gutfeld! (on cable/faux news variety) are capturing younger viewers and higher ratings in that segment.

- Other legacy late-night shows are also suffering—but Kimmel’s drops are especially steep because ABC has not meaningfully retooled or repositioned the show in response to shifting audience demands.

Part II – Financial Cost: Losing Money, Losing Faith

Ratings are one thing; profits are another. When ratings decline, advertisers pull back, production costs eat up more margin, and networks face hard choices. Here’s what we know (or can reasonably infer) about the financial fallout.

Direct Costs

- Ad revenue declines: As viewership in the key demo (18-49) shrinks, advertisers willing to pay high rates for those eyeballs also shrink. Shows that used to command premium CPMs for that audience now have less bargaining power. While specifics for Kimmel are not fully disclosed, reporting suggests ABC's late-night programming is losing money.

- Production overhead: Even moderately sized late-night shows incur sizable fixed costs—studios, crew, booking guests, etc. When viewership drops, per-viewer cost increases sharply. There’s no published ABC breakdown showing Jimmy Kimmel Live! profitability, but given the viewer declines, the fixed cost burden implies reduced efficiency.

Reputation and Indirect Financial Risk

- Affiliate backlash: In September 2025, after controversial comments by Kimmel about Charlie Kirk’s assassination, some major ABC affiliate station groups (Sinclair, Nexstar) refused to air Jimmy Kimmel Live! on their stations. That kind of refusal threatens both ad revenue (fewer markets airing the show = lower reach = lower ad rates) and broader affiliate relationships.

- Subscriber cancellations / brand risk: Several reports claim that Disney lost subscribers or faced public backlash following Kimmel’s monologues, though specific numbers are fuzzy. Some outlets floated that Disney might have lost $4 billion due to the Kimmel row—but this number is not backed by concrete data in public reports.

Net Loss Estimates & Profitability

- For comparison, The Late Show with Stephen Colbert was reported in certain internal CBS circles to be losing “upwards of $40 million per year”, even as it remained top in its genre. That suggests that the late-night format is under serious financial strain.

- If similar dynamics apply to ABC/Kimmel, each percentage point drop in viewership in key demos could correspond to millions in lost ad income. Margins in TV are thin; revenue losses tend to cascade.

Part III – Ideology, DEI, and Creative Community: What’s Driving the Problem (Beyond Just Numbers)

The decline is not merely technical; it’s cultural. The network and creative class’ decisions—about tone, subject matter, ideological alignment—matter more when audiences have alternatives. The late-night audience isn’t captive anymore; streaming, social media clips, TikTok, podcasts—these platforms are where people go for entertainment and commentary.

DEI, Echo Chambers, and Narrative Control

- Many viewers feel late-night has become less about satire or observational humor and more about moralizing from a specific political or cultural angle—often aligned with progressive causes or DEI (Diversity, Equity, Inclusion) priorities. When the jokes are predictable, when the targets are always “the same,” and when there’s little self-scrutiny, audiences grow fatigued.

- DEI efforts, while theoretically aimed at elevating underrepresented voices, often translate (in practice) into safe topics, cautious guest selection, and rigid ideological boundaries that limit comedic risk. The kind of edgy or uncomfortable satire that once drove ratings doesn’t always pass modern sensitivities. That reduces variety, surprise, and tension—all ingredients of good comedy.

Creative Community & Hollywood’s Safe Investments

- Hollywood’s inner circles (producers, executives, talent agents) often reward ideological alignment—public virtue signaling, DEI compliance, etc.—over pure market feedback. That means executives may keep shows alive that perform poorly if they believe they need the show for “diversity,” for public relations, or to signal they are part of the creative “club.”

- Risk-taking is lower. Guests, monologue topics, jokes—many are filtered to avoid backlash rather than to maximize laughs or relevance. That plays to “safety” rather than effectiveness. Kimmel’s recent controversies show how quickly backlash comes if a host strays (or is perceived to stray) from the accepted line; and how networks are quick to suspend or distance themselves—not just for public relations, but under pressure from affiliates or regulatory bodies.

Part IV – Disney’s Role: Propping Up the Problem

Disney (through ABC) is not innocent in all this. The company’s decisions—what to air, when, how to react—have enabled Kimmel’s continued presence despite steep losses.

Why Disney Keeps Kimmel On

- Contractual obligations / legacy investment: Kimmel has been on the air for over two decades. He has infrastructure, staff, a known brand. Unwinding all of that is hard and painful.

- Fear of backlash or legal/regulatory risk: When Kimmel makes controversial statements, Disney often responds with suspension, or distancing. But usually without cutting him loose. Because if they do, they risk being accused of censorship or ideological overreach themselves. It becomes a political risk calculus.

- Brand protection via loyalty to “creative community”: Hollywood culture tends to reward insiders. Keeping Kimmel—even if he's losing viewers—may be seen internally as defending creative freedom. But that loyalty, when divorced from market feedback, becomes a liability.

Where Disney Is Failing

- Failure to pivot: While viewership trends have made clear what younger audiences want—snappier content, shorter segments, more unpredictable comedy—Disney has not meaningfully retooled Kimmel’s show or the late-night format to match.

- Reactive rather than proactive: When controversies occur, Disney reacts (suspensions, statements) rather than setting clearer policies ahead of time—or selecting hosts/monologues/etc. that are more in tune with audience expectations.

- Overreliance on ideology: Disney leans heavily into DEI, progressive signals, and sometimes punishing or censoring dissent. But culture and politics are not stable brands—public opinion shifts, backlash grows. Companies that tether themselves too tightly to ideology risk rapid erosion of their broader audience.

Part V – The Case Study: September 2025 Suspension & Fallout

The recent suspension of Jimmy Kimmel Live! over Kimmel’s remarks about Charlie Kirk’s death is a sharp illustration of all the above dynamics in motion, and a real-world test of Disney’s priorities.

Timeline of Events

- Monologue: On a September episode, Kimmel made remarks tying the assassination of conservative activist Charlie Kirk to reactions from the MAGA movement, which drew heavy criticism.

- Affiliate Pullback: Major ABC affiliate station groups (Sinclair, Nexstar) refused to air the show in some markets unless Kimmel apologized or the network took action.

- Suspension: ABC (Disney) suspended Jimmy Kimmel Live! indefinitely, in effect conceding to public/regulatory and affiliate pressure.

- Return: After about a week, ABC reinstated the show. The decision followed discussions with Kimmel. Some affiliates (Sinclair especially) continued to resist airing it in certain markets.

Financial & Viewership Impact

- Viewer loss: Ratings had already been falling sharply in the months prior. The suspension exacerbated that decline in reach and risked further erosion in advertiser trust.

- Advertiser risk: Ads scheduled in markets controlled by affiliates that refused to air the show were disrupted. Advertisers pay for reach; when affiliates pull content, value drops. Disney risked losing advertiser dollars in those markets.

- Stock/brand risk: There was speculation (though not confirmed) that Disney’s stock dropped after the suspension. Public perception and backlash can translate into financial risk (subscriptions, merchandise, secondary business lines).

What We Don’t Know (But Can Infer)

- We do not have publicly confirmed data that Disney lost $4 billion due to this incident. That figure appears in media speculation and overblown social-media claims.

- We don’t yet have a breakdown of how ad rates changed (if they declined further) because of the suspension.

- We don’t know long-term damage: how many viewers permanently stopped tuning in, how many advertisers dropped out, and how affiliate relationships will shift in future.

Part VI – Big Picture: What This Means, and What Could Be Done

If you step back, the Kimmel case is more than a scandal—it’s a warning sign about structural risk in traditional broadcast media and entertainment.

Cultural Risk & Audience Alienation

- Audiences are not monoliths. But many who are declining to watch late-night now report that shows feel preachy, repetitive, or clutched too tightly to progressive political or cultural orthodoxy. Comedy used to challenge norms; now many feel it simply reinforces them.

- Younger viewers are shifting to platforms where content creators feel freer (or at least less constrained) to experiment—YouTube, TikTok, podcasting. If broadcast TV wants to stay relevant, it has to compete on their terms, not insist they come to it.

Financial Risk Must Drive Strategy

- Broadcast networks need to quantify the losses from shows like Jimmy Kimmel Live! and compare them against costs of replacement, reformatting, or pivoting. Sometimes cutting bait is less costly in the long run than propping up failing shows.

- Rather than hoping that ideology will hold an audience, networks should invest in data: Which hosts, which styles, which content do audiences want? Take risks on content that might offend the elite or the industry insiders—but entertains the masses.

Possible Paths Forward

- Format overhaul: Shorter monologues, more variety, more interactive content. Don’t assume linear TV habits still hold.

- Host diversification: Rotate hosts, bring in voices outside the usual late-night sphere—regional talkers, comedians with non-Hollywood backgrounds, even cross-platform creators.

- More nimble production: Lower fixed costs, more adaptable segments that can shift with public mood.

- Clearer boundaries: If you are going to ingest political content, establish ahead of time what the show's voice is. Audiences prefer honesty over surprises in tone. If the show will be ideological, then lean into that intentionally; if it wants to be funny first, then avoid being dragged into controversies when possible.

Part VII – Conclusions: Kimmel Is More Than a Symptom

Jimmy Kimmel is not just a name or a late-night host. He is, in many ways, a monument to what went wrong when entertainment agencies stopped listening to consumers and started listening only to elites, regulators, and ideological peers. He’s a case study in how ratings collapse, how financial losses build, how affiliates and audiences rebel, and how a company’s ideals (or fears) can override its business sense.

If Disney continues as it has—clinging to legacy hosts, over-emphasizing ideology, under-prioritizing audience feedback—it risks not just losing Jimmy Kimmel Live!, but losing its leadership role in entertainment. And for a company built on storytelling, imagination, and mass appeal, that loss would be deeply ironic.

The choice is stark: evolve or fade. And right now, the numbers are harshly pointing toward the latter for ABC and Jimmy Kimmel.

References

- Barron’s. (2025, September 12). Jimmy Kimmel will return to ABC after suspension. Retrieved from barrons.com

- Business Insider. (2025, September 12). Sinclair, Nexstar refuse to air Jimmy Kimmel on ABC affiliate stations. Retrieved from businessinsider.com

- Cord Cutters News. (2025, September 6). Viewership for Jimmy Fallon, Jimmy Kimmel, Stephen Colbert are down up to 80% over the last 10 years for the key 18–49 age range. Retrieved from cordcuttersnews.com

- Fox Business. (2025, September 19). Jimmy Kimmel Live once a moneymaker for ABC now part of late-night decline. Retrieved from foxbusiness.com

- Hindustan Times. (2025, September 12). Did Disney lose $4 billion over Jimmy Kimmel row? Retrieved from hindustantimes.com

- New York Post. (2025, September 18). Jimmy Kimmel’s ratings were slipping before ABC suspended him for Charlie Kirk comments. Retrieved from nypost.com

- Wikipedia. (2025). Gutfeld! Retrieved from en.wikipedia.org

- Wikipedia. (2025). Suspension of Jimmy Kimmel Live! Retrieved from en.wikipedia.org

Disclaimer

The views expressed in this post are opinions of the author for educational and commentary purposes only. They are not statements of fact about any individual or organization, and should not be construed as legal, medical, or financial advice. References to public figures and institutions are based on publicly available sources cited in the article. Any resemblance beyond these references is coincidental.